This time its different #Nifty

After weeks of nightmares about how to fund today’s Marked to Market margin, Bears finally had something to be happy with Nifty cracking by 1.3% by end of day. While a 1% fall in markets should be common enough, it was something that was missed in the last 24 days.

In a bull market, one is told that the best way to participate would be to buy on every dip. While it makes a lot of sense in theory, the question is how to apply it practically. After all, how does one know whether we have seen that dip or not.

Unlike most pundits on Twitter and Television, I do not have a crystal ball to say where one should Buy or Sell. On the other hand, with the help of some Statistics, its possible to compare contexts with how markets have behaved historically and come to a educated guess.

Lets first start with the most basic question. Have the markets gone up too much too fast? In the last one year, markets have gone up by around 60% and considering the circumstances in which this has happened (change of government, US markets in a strong bull market, economy seeming to show signs of bottoming out among others), this is something that is acceptable. After all, markets discounts the future and markets believe the future is pretty good compared to the immediate past.

The key difference between the current bull market and the one’s we have seen previously (2000, 2003, 2009) is that those rallies were born out of pessimism. Markets had become pretty cheap (when measured via trailing Nifty PE), we started off the rallies with Nifty PE being around 10 whereas in the current instance, markets started off without being too cheap (we never dropped below 15).

Today, Nifty 4 Quarters trailing (Standalone) PE stands at 21.09 and just a few days ago tested the 1 Standard Deviation. Coincidentally, this is the same level from which markets reacted in 2003 (chart below) and while the circumstances are hugely different, some reaction from this level maybe given as per this data.

Previous bubble burst’s have happened when Index was well over teh 2nd Standard Deviation (and pretty close to the 3rd), so in this instance, we can rule out the possibility that the current rally was a bubble and the hope that this may result in a straight line fall.

This rally has been different in a lot of ways, much of which I believe is due to the Quantitative Easing that has resulted in a flood of liquidity resulting in most markets seeing a very low historical volatility and a constant bullish undercurrent.

Take a look at the following chart for example

The lower pane shows the number of weeks since we saw a 5% cut (on weekly). Since 2010, we have had just 1 week where markets fell by more than 5% (week ending 18th November 2011).

Now check the following chart

Between 2003 and 2008, when Indian Markets saw their best bull markets ever, we had reactions coming in constantly. The longest period we spent without a week where we saw a 5% correction was 74 weeks (compare that to 148 weeks we are seeing currently).

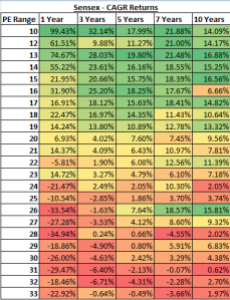

As much as I believe that the future looks good, the best returns are found when we buy it cheap. The markets are not as cheap but not very expensive either which puts us in a dilemma. Take a look at the spreadsheet I had posted in July of this year

As you can see, above 21, the returns over the 3 year time frame get into negative territory. Of course, this being the average, you may see a +ve returns as well, but the probability goes lower as we go higher.

Technically speaking, we have not seen a good support range appear after we broke above the previous high of 6300. Interestingly that is also a level breaking which we are sure to get into a bear market.

A 20% reaction from the current high while may not appear to be in order, we have had a draw-down of 13% (Average), something we have not seen in 2014. So, even if we were to react 10% from the high, that would mean a test of 7300 levels.

For now, fresh investing can wait till we see a moderate correction at the very least.

Recent Comments