A deep dive into The Zurich Axioms

Many years ago, someone had recommended The Zurich Axioms by Max Gunther and I remember reading it though I doubt I took home any lessons. Recently I got a physical copy and decided to read it once again. Much water has flown since my last read and while I doubt it has influenced me, experience helps me understand the book better today.

There are some good lessons. What I have tried to achieve in this long post is to provide a synthesis of the Axioms and how it relates to us.

Axiom 1: On Risk: Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.

The basic thought process behind this chapter is that one should risk big enough that if right it makes a difference to the portfolio / net worth. Nothing disagreeable in this statement and this is also something I believe and implement at a personal level.

Where I disagree with is how to take such bold risks. He asks the reader to resist the allure of diversification and instead take not more than 4 positions. For my mother, I have invested in a Value ETF, a Momentum ETF and an International ETF. In theory, this is concentrated while in reality this is a very well diversified portfolio.

My own personal portfolio is 30 stocks. That may sound too diversified until one also learns that it’s also 90% of my Networth at which stage it appears way too concentrated. So, is this Concentrated or Diversified?

Concentrated positions are what can make big money but unless you are running the show at the company where you have invested, the risk is enormous for you have no control (even if that alone won’t make a difference).

A retail investor is better off with just one equity fund – Nifty Index Fund. In theory, it’s a concentrated position, in reality, it’s more diversified than most other investments.

A quote I loved in the Chapter –

All investment is speculation. The only difference is some people admit it and some don’t

Gerald Loeb

Axiom 2: On Greed: Always take your profit too soon.

It doesn’t matter if you are an investor who buys based on fundamentals or an investor who buys on Momentum, one quote from Warren Buffett that applies everywhere is.

Selling your winners and holding your losers is like cutting the flowers and watering the weeds.

Finding winners is tough and when you find one, why cut down the position way early in time. While I buy on Momentum with willingness to sell the very next month, I am happy to hold a stock as long as it’s going up. Why book profits on what is working out well.

There is a well-known saying, “No one ever went broke taking profits”. Again, looks good in theory but the issue is that big profits come out of very few stocks one picks up in his career.

In my own experience, 90% of my portfolio returns are driven by just around 10% of the stocks I picked up. Rest 90% of the stocks were more or less meaningless positions. If I had cut those positions early, I would basically have a performance that would have been beaten by IDFC Savings Bank returns.

This logic may work if one has a winning hand in a roulette wheel (the book has an example using this) where the reason for the win is pure luck. But where there is skill involved, getting out early can be disastrous in the long run.

Axiom 3: On Hope: When the ship starts to sink, don’t pray. Jump

A long time back, I had tweeted this,

This chapter is about getting out when things go wrong. Risk management is the key to staying in the game and one can win only if one continues to play.

For the stock investor, the book says that Gerald Loeb’s rule of thumb to sell whenever a stock has retreated 10 to 15 percent from the highest price is a good place to sell. I myself use a 25% filter, so in a sense I agree.

But even with a wider level, I have observed that there is risk that I may get out of a good stock well ahead of time. I look at this price filter only once a month and hence in a way reduce the risk of getting out due to normal vagaries of the market.

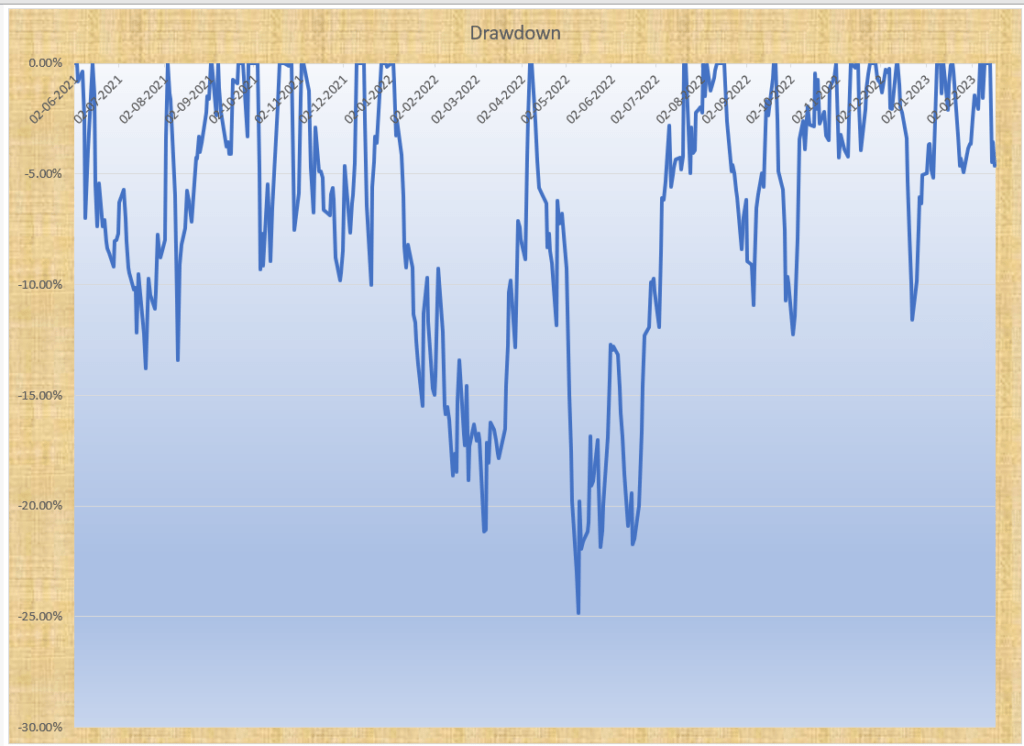

To give an example, my biggest winner is a stock I have been holding since June 2021. Look at the drawdown chart from my entry level

A 10% or 15% cut off level may have cut off my position way before today. Even the 25% was nearly tested one time but since it came in the middle of the month, I survived. The tradeoff is that some stocks may continue to go down and I will hold to the same till the end of the month. But based on data, I think this an acceptable trade off.

You take small losses to protect yourself from the big ones is a good approach to have.

A good quote from the chapter

“What makes a good poker player?

Knowing when to fold”

- Sherlock Feldman

Axiom 4: On Forecasts: Human behavior cannot be predicted. Distrust anyone who claims to know the future, however dimly

Most of us associated with the stock markets are guilty of forecasting. Kya lagta hai market is an often-asked question to anyone who is in the market. Friends ask me this repeatedly even when they know that my view is no better than theirs. When I differ with their view, arguments follow to try and showcase whose forecast is better.

Business Channels have forecasts broadcasted day and night. From where the Index can go to where a particular stock can move to what Inflation and Interest shall do. There are experts who can predict everything. If only someone collated to showcase how bad most of these predictions are. But then again, Television should be used as Entertainment and nothing more.

While predictions in itself are totally a coin toss game at best, they do provide some succor to the investor. When markets cracked during Corona, I had a lot of people call me up to try and understand what to do. My own portfolio was down 30%, so in many ways I was in the same boat.

All I could repeat to many of them was “All izz Well” from the movie 3 Idiots. All I tried to emphasize is that the world is not ending and not to panic sell during these times. While in hindsight I was right, It was not evident to myself let alone others. But the prediction of good times I hope ensured that at least a few of them stuck to their investments and reaped the benefit of the bounce we saw later.

A lovely quote from the chapter

“It’s easy to be a prophet. You make twenty five predictions and the ones that come true are the ones you talk about” – Dr. Theodore Levitt

Axiom 5: On Patterns: Chaos is not dangerous until it begins to look orderly.

Mixed feelings about this book where he trashes Mutual Funds (even those that have done well), Technical Analysis and even Momentum. Interestingly there seems to be a old book by Lewis Owen called How Wall Street Doubles My Money Every Three Years: The No-Nonsense Guide to Steady Stock Market Profits where Owen says one should buy stocks that are nearing or hit their twelve month high. This book was published in 1969, just a few years after Warren Buffett had purchased Berkshire Hathaway.

The author believes that Luck plays an oversized role in all investments and that much of markets are all Chaos with no Order. But how far is that true? Commodity Trading Advisors should not have existed for decades if trends were nothing more than an illusion.

Jim Simons once said that he himself did not understand why certain patterns continued to make money year on year. Fundamentally they made no sense and yet, they made money and he was happy with it.

Discarding patterns without testing its validity is like throwing the baby with the bathwater. Not all patterns can be fully explained and this includes things like Momentum.

Axiom 6: On Mobility: Avoid putting down roots. They impede motion

The name of the chapter is a misnomer. What he actually talks about is not falling in love when it comes to stocks. Great many fortunes have been whittled away because the emotional attachment when the time to sell was right was too high. Once a stock starts to fall, our own behavioral biases such as Anchor bias ensures that we may never get out of the stock.

One of the biggest advantages an asset class like Equity offers is the ability to exit and move to cash with ease anyday. Physical Gold too can be sold and converted easily to cash except for the minor fact that the fee for conversion is pretty high. With Real Estate, one maybe a seller for a year and more and not find a buyer unless its sold at a deep discount.

“Only buy something you’d be perfectly happy to hold if the market shut down for 10 years” says the sage of Omaha

The issue is, how much of your money will you be willing to invest if you cannot sell something for 10 years. The general view will be a small amount for we don’t know how the future shall unfold and when we may require the sum invested. But this clashes with Axiom 1 view. If you are not betting enough, the gains, even if huge in percentage terms, may not really move the needle.

Liquidity is very important regardless of whether you are a short term investor or long term. Robert Nou of Punch Card Capital who has a excellent track record while investing based on long term approach had this to say

“I used to think that the liquidity of an underlying security didn’t really matter, because if you plan to hold it for a long time, it shouldn’t matter that you can’t trade in and out of it every day or month,” he said. But, as he discovered in 2008, illiquidity makes it difficult to swap out of a position when you find something better to buy. “I don’t avoid illiquid things now, but there is a potential opportunity cost that I now take note of that I previously did not place any weight on.”

Source: Sangtel’s Review

Axiom 7: On Intuition: A hunch can be trusted if it can be explained

From here onwards, I felt that the book started to go down. The author believes that it’s a mistake either to laugh at hunches or to trust them indiscriminately. He suggests that it can be useful if handled with care and skepticism.

As is the case with all the chapters, he provides examples to show how someone had a hunch that worked out in her favor. With a sample size of 1, he then suggests that hunches aren’t meaningless dreams but based on all the data we have observed and absorbed but one we may not be fully aware of.

Gut feel is the world I have seen a lot of investors and traders use when taking a position. Just today I was talking with a friend who lost quite a bit of money because his gut told him that the fall in the market had happened when in hindsight, it was just the start.

Gut feels aka Intuition is untestable. We only remember the ones that came right, never ones that went wrong. This in many ways tilts the way we think, making us feel superior when the reality may be the other way round.

Atul Gawande wrote a wonderful book titled The Checklist Manifesto: How to Get Things Right which talks about how the mind plays tricks and how the best way to protect oneself is to have a checklist that one can check to see that one is not really missing out.

Being a quantitative based investor has been the best decision I myself have made. Quantitative investing doesn’t guarantee success but at the same time, it’s easy to perform a post-mortem to understand why we fail if we fail. When our Intuition / Gut fails, we have no way to learn from the mistake.

Axiom 8: On Religion and the Occult: It is unlikely that God’s plan for the Universe includes making you rich.

Outside of Bangalore Stock Exchange premises for a long time I saw a tarot card reader. Not once in the nearly 20 years I have spent there did I see him seeing someone who was associated with the stock market. His clientele was a different breed.

One of the controversial men who have left their mark in the world of Finance is W.D. Gann. His trading methods among other things included Astrology.

While Indians are strong believers in such stuff, other than for making a customary purchase on Dhanteras day, I barely saw much importance given to Astrology or any other beliefs when it came to investing.

This is an Axiom that I doubt has many takers in the world of finance, at least not in India.

Axiom 9: On Optimism and Pessimism: Optimism means expecting the best, but confidence means knowing how you will handle the worst. Never make a move if you are merely optimistic.

Being an optimist, I actually like this chapter which talks about the risk of unbridled optimism. Most businessmen are optimists. Same is true for Fund Managers too.

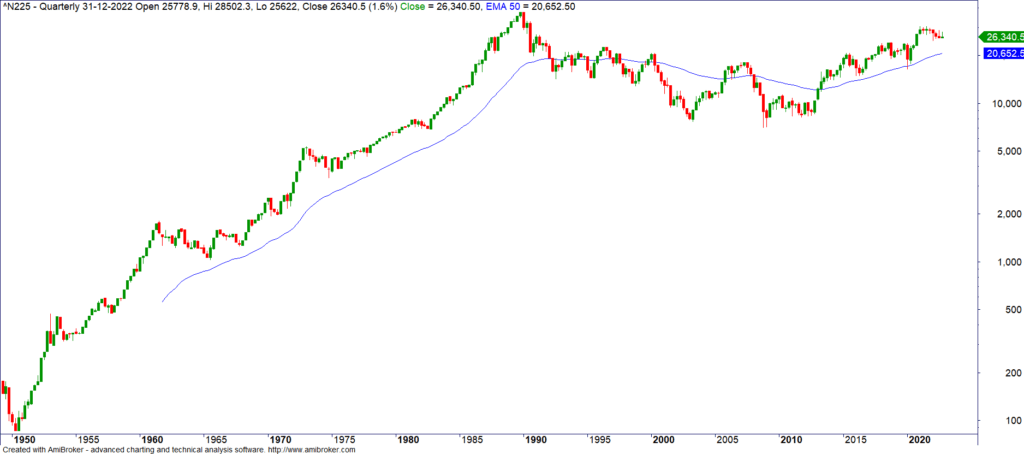

Keynes is supposed to have said, “In the long run we are all dead”. Long Term charts of any markets have gone only one way – Up. What about Japan you may ask. Well, here is the long-term chart of Japan’s Nikkei 225 Index. Chart is in log scale.

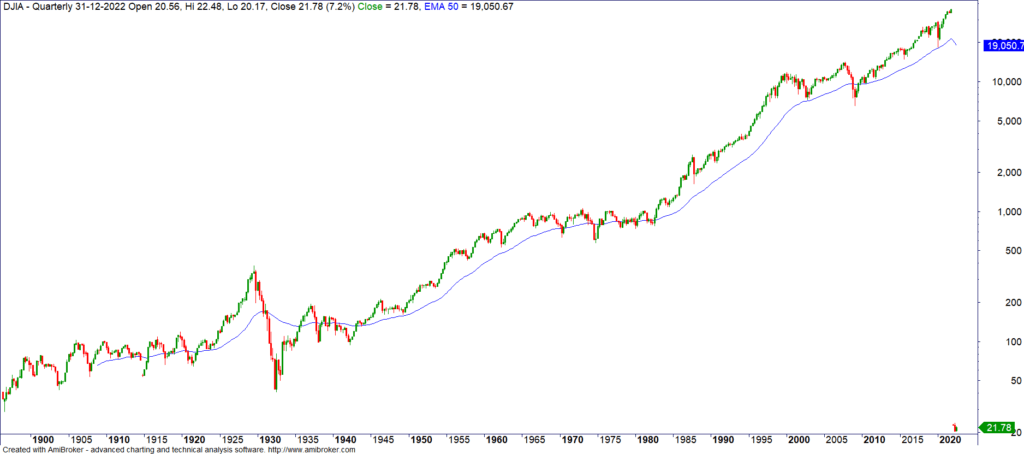

The Great Depression in the 1930’s in the US. On a long enough scale, it looks tiny even though the high of 1929 was broken only in 1954.

Optimism is good but over optimism is what kills businesses and investors alike. While stockbrokers are generally seen to be optimists, I know a great deal who are skeptical a lot of times if not outright pessimists. Again, going overboard has meant that many never accumulated even the basic gains that markets have delivered over time.

2004 was an interesting year. In 2003, we had one hell of an amazing year with Nifty recording its highest ever gain in any calendar year since its inception. The high of the dot com bubble seemed to have been decisively crossed.

2004 was an election year but one most felt was just a formality for Vaypayee to come back to power. India was Shining they said and most of us drank the kool aid.

The first four months saw not much action in the Index though stocks had started to creep lower. But, this is normal was the feeling of most of us optimistic that the markets shall go upwards as results came in favor of the NDA government.

Personally, I held very little position since much of my capital was locked in the Stock Broking firm I had just taken over. So, it was just munching popcorn while election results came out. Friends of mine with deeper pockets though were fully invested to take advantage of the upcoming rally – a rally that seemed predestined to happen.

The first sign of something was not right came towards the end of April post the day of the 2nd leg of elections. The bigger slide started once exit poll results came in showing NDA in trouble. Interestingly on counting day, 13th May 2004, Markets actually crept up. A stable government was what it was looking for, be it from the Congress or the UPA. All hell broke loose on 14th and then on 17th when in between (14th being Friday and 17th being Monday), when CPI-M Boss, CPI-M General Secretary Harkishan Singh Surjeet said “we cannot afford it (disinvestment programme followed by the NDA). We oppose disinvestment of profit making PSUs. All the mistakes of the NDA government have to be rectified

Ultimately UPA did not totally reverse the policies of NDA though it changed the way disinvestment was done. But for the speculator, the damage was enormous. Nifty was down 36% at the day’s on 17th May and most leveraged positions were squared off.

In many ways, that was a learning lesson for me in having a plan to exit rather than depending on my own view of how the market shall behave. The best thing I have loved about Momentum Investing that I practice today is that in the unlikely case of a market crash, I know I shall be out even if I have to give up a part of the capital as an offering.

Axiom 10: On Consensus: Disregard the majority opinion. It is probably wrong.

Again, a mixed view about this chapter.

The crowd is actually right most of the time. The problem arises when at the end. When markets are bullish, the crowd is generally long and right. When the crowd becomes a mob, it generally lends to the feeling that the end is nigh.

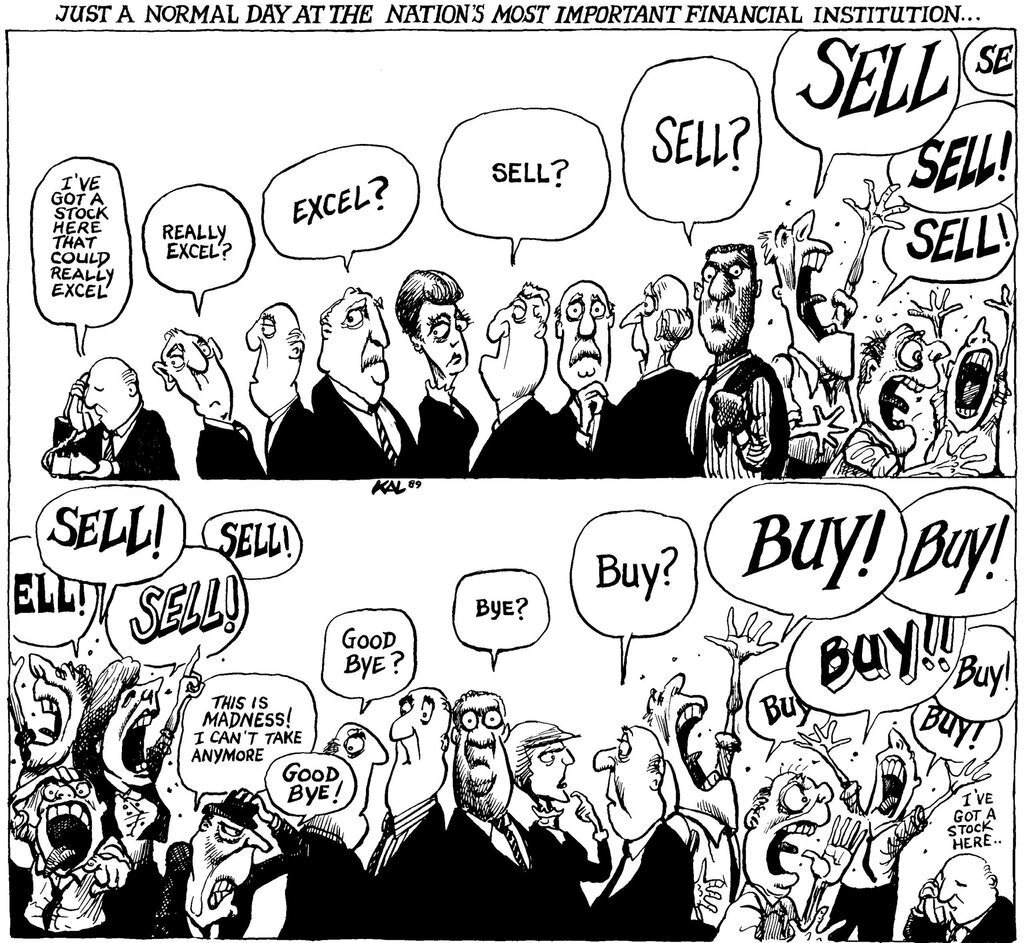

Kevin Kallaugher’s famous cartoon in many ways depicts the change of sentiments by the crowd.

When the markets are bullish, the crowd for most of the while is actually bullish. Going against the sentiment when we aren’t sure that the trend has exhausted is a sure fire way of getting bankrupt sooner than later.

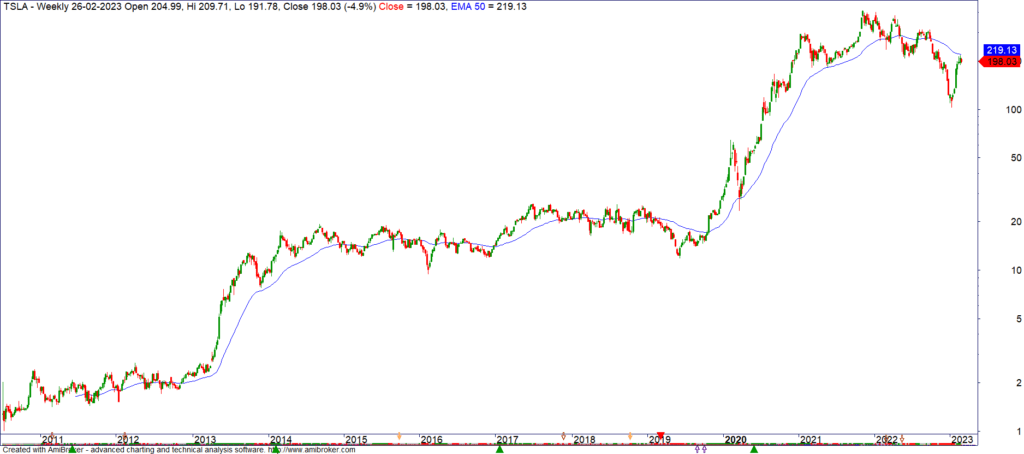

Take a look at the price chart of Tesla, a company that attracts equal attention by believers and naysayers alike.

At one point of time, it was one of the most shorted stocks. But rather than fall, it caused so much untold agony to fund managers that many, while believing that Tesla will die one day, don’t want to bet on it.

The crowd on the other hand was and even today is very bullish on the prospects. Those who have been bullish from before Corona are still in profit even though the stock is today down more than 50% from its peak.

Those who would have lost money or underwater in their investments trying to follow the crowd are almost everyone who entered Tesla from 2021 onwards. What this suggests is that rather than following or no following the crowd, one way to stay ahead is to have a good risk management system ( Axiom 3)

Where the crowd generally gets it wrong is when the stock is trending down. Bottom fishing is the bane of most investors. When you buy because you feel the stock has become cheap, it’s difficult to exit when it becomes even cheaper.

Not all bottom fishing is wrong, just that one needs to understand the risk and have a plan beforehand to deal with all sorts of outcome.

Nearer home, Pharma started to become a hot sector for investors. My own portfolio was having enough Pharma stocks to make me think on where we are in terms of the rally

The rally continued for months before peaking out in October 2021. Once Momentum ended, stocks started to drop off over time. While the sector will have another rally at some point of time, the advantage of having a strategy that removes stocks once it starts to go down has huge merit in terms of managing Risks.

I am reminded of George Soros famous quote on how to deal with bubbles

“When I see a bubble, I rush in to buy it.”

Axiom 11: On Stubbornness: If it doesn’t pay off the first time, forget it.

Current trend is Revenge Travel. Revenge Investing / Trading on the other hand is something that a lot of investors actually implement.

If I lose money buying say Infosys, some traders try to recover the same through trading Infosys and not any other stock. Stocks have no memories or do they have personal agendas.

In many ways, we as investors and traders are stubborn when it comes to our beliefs and notions. Stubbornness isn’t an entirely bad philosophy for every strategy goes through its good times and bad. Investor behavioral gap comes from the inability to stay the course when the strategy isn’t working.

I recently asked Swarup Mohanty on how long one should stay invested in an underperforming fund if the fund itself is sticking to the strategy. His answer, 3 years.

While there is no hard and fast rule on how long one should give time for a strategy to perform before pulling the plug, being stubborn even as data shows that more time may not resolve the issue benign faced will only result in permanent opportunity costs and one that over time can add up to a decent bundle.

Meb Faber for instance believes that a reasonable time frame to evaluate a strategy or a manager is 10, if not 20 years.

Cutting down exposure to a strategy too early is as bad as cutting down exposure too late. One could always argue that with wide diversification, one can give a longer rope. But this will violate Axiom 1 – bet enough that it matters if it wins.

Axiom 12: On Planning: Long-range plans engender the dangerous belief that the future is under control. It is important to never take your own long-range plans, or other people’s, seriously.

A current trend and one that is advocated by many is to plan for one’s goals as early as possible. Thanks to Microsoft’s amazing software called Excel, punching in a few numbers is all it takes to say, if one were to invest X per month every year for the next 20 or even 30 years, every goal you have in mind today will be fulfilled.

In some ways, this gives a comfort to the mind but how true are such projections. 12% long term returns are seen as a conservative number to be used for such plans. Nifty 50 long term returns too are in the same range. But if you break it down to say 5 year rolling returns, you can see that Nifty 50 also had times when the 5 year return was negative.

If you are a young investor, you should wish for a Bear Market. A bear market means low stock prices and hence when you are starting off, it helps you buy more or so goes the logic. Bear markets are most of the time accompanied by weak economic conditions.

Would you want cheap prices while at the same time having a hard time finding a job or worse. In the movie The Matrix, there is this wonderful dialogue on what good is a phone call if you are unable to speak

In life, most of what we do is fluid. Be this related to our Jobs or our Expenses. Some risks work out exceedingly well, some don’t. When advisors ask investors to eschew risks, they are correlation risk and return in a way that doesn’t really work in the real markets.

Leverage can be either good and bad not on where it was deployed but more importantly on the end outcome. Anyone who took leverage and invested in Real Estate has seen his net worth swoon up while many who took a much lower leverage but in the financial markets have seen their net worth get eroded.

All in all, this is a decent book for someone who is new to markets as also someone who has a fair bit of experience. But like everything else, nothing is to be taken as gospel. Questioning helps provide perspectives and understanding.

Recent Comments