The 3 Percent factor

So, with markets going downhill by approximately 3%, there is a lot of noise associated with this incident in the financial world. Since Sensex has crumbled by 850+ points, that should be the big heading for most pink papers tomorrow.

But this is not even its biggest or even 2nd biggest fall (even when measured in point terms which is pretty wrong considering that when Sensex started, we had a value that was less than the fall of today). In fact, today’s fall is the 7th largest when considered in terms of points and 232nd or somewhere around when measured point wise.

There are many interesting things with todays fall which suggests to me that while this is not a start of the fall like one saw in 2008 (which is in the memory of most investors / traders), this fall does not signify a short term bottom either. So, before we jump into the market with most of us being on a Buy on Dip mode, shall we check out the evidence in hand?

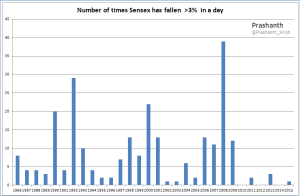

While its true that a 3% fall had not occurred for a long time and hence may have come as a surprise, the fact is that through out the bull run between 2003-2008, we had multiple such instances. Its only since the surge in 2009 that we are seeing longer rallies without any corrections.

In fact, as the chart below shows, until 2010, we did not have a year without at least one 3% correction. As you can see, even in strongly bullish years of 2005 / 2006 and 2007, we had multiple instances where market corrected by 3% or more in a day.

On television, I observed a news flash which informed me that the markets had broken the 100 day DMA. That in itself would not make news on any other day, but on big days like, even small factor seems to get blown up. For markets to enter what is known as a bear market, the general measurement is either a 20% fall from the peak or the break of the 200 day DMA.

Currently, the 20% level for Nifty comes to 6901 while the 200 day DMA comes in at 7658. Both are pretty far to make one worry at the current juncture.

Lets now take a look at the Nifty PE (Trailing 4Q, Standalone).

Not much of a change there. While market has fallen, there is nothing to say, that its a cheap market out there, especially considering the rate of growth we are seeing in Nifty companies. It would be interesting to see how the results crop up for Q3 when they get released in this month.

The breadth indicators generally give a indication of the current market situation. I had tweeted about how the number of companies that were trading above the 10 day EMA was lowest in years on 17/12/2014 and the markets promptly went up from there. As on date, of the companies listed and traded on NSE, 65% of them were above the 200 day, 46.5% were above its 60 day EMA and 36.8% were above its 10 day EMA. No sign of a large scale selling pressure.

In fact, if you were to check the performance of stocks in F&O, no stocks had a fall >10%. Since de-leveraging starts first in FNO stocks, this is something to note. On days when there is total capitulation, you can see stocks closing with losses or 20% or even more. Not today though.

In fact, the number of stocks that advanced to a new 52 Week high were greater than the number of stocks that hit its 52 Week low. While small cap index too fell by 3%, it seem that a lot of stocks not only escaped the fall unscathed but logged gains as well.

All in all, while markets did fall pretty hard today, the facts above seem to indicate that this is not the end or we are not even close in that regard. There is no reason that we should see a crash similar to 2008 unless there is total world capitulation, but we need to fall even more before we rush to buy the dip.

Markets are in a long term bull market and there will be several opportunities where fresh money can be invested to take advantage of the same. But if one is not careful in choosing when to deploy those funds, it may in the short term actually cause grief due to one being too early.

While I am not a great believer in many a pattern, we do seem to be seeing a slanted Head & Shoulder pattern form on the Nifty chart. Going by this chart, if we were to break the 8000 barrier, we may get to see 7400 (which incidentally is a pretty nice support as well).

January has had once of the worst records amongst all other months and this time seems to be no different though we do have quite a number of days to go before we conclude that January has behaved as per its historical standards.

Trade Well, Be Safe 🙂

Metal and Oil are worst performing….it is like 2008 coming with respect to it…

Reblogged this on investorhorizon12.