The Contrarian Fund Manager – Prashant Jain

Peter Lynch is seen as one of the greatest fund managers even though the period where he managed real public money is of a time frame that is extremely short when one compares him with other great fellow investors.

Prashant Jain has been managing what today is known as HDFC Balanced Advantage Fund (but earlier known by other names) for what very few fund managers have managed historically. 1994 to 2022 is a very long period for an open ended mutual fund manager to be at the reins of any fund. The only person who I can name and one who has a phenomenal track record of his own is Anthony Bolton who managed Fidelity Special Situations fund from December 1979 to December 2007.

If you wish to check out more about Anthony Bolton, do check out his book Investing Against the Tide: Lessons From a Life Running Money

Do note that while he was part of the funds since the start (as Head of Equities), he wasn’t the CIO of the funds themselves until a much later time (2001 for HDFC Top 100, 2003 for HDFC BAF and 2003 for HDFC Flexicap). But since he was involved in the decision making process, I am looking at the complete cycle vs only from when he assumed full control.

Note: While I shall use the current fund names, most of them went through different names and objectives in the past.

How does one assess a fund manager whose timeframe of managing money is greater than what the average age of an investor is today. He started at a time when today’s dominant exchange, the National Stock Exchange, just about commenced operations.

One of the complaints that most investors have with fund managers who manage funds, large or small, is that many of them are just closeted investors. In other words, they try to mimic the Index pretty closely and hence generate returns that are no different from the Index but for which one ends up paying a fee that is multiple times that.

Regardless of whether you are a believer in him or not, one thing that most won’t disagree with is that Prashant was less of a closet indexer even though as the size of his fund grew, it obviously would have placed a limitation on where he could invest.

He was lucky too. His bad bets, even with which he was able to closely generate Index returns, came after he had already made a name for himself. If the path had differed and he had made similar bets in the past when he was not really well known, it’s doubtful we ever would have heard of him.

Breaking down the Performance

Let’s start by looking at the yearly performance of the 3 funds he managed vs the Sensex returns. Do note that while Mutual Fund returns are Total Returns, I am using non Total Returns of Sensex since Total Returns data doesn’t go as long back as the 90’s

1999 (when he was not the fund manager) and 2003 (when he was) were blockbuster years for all their funds. The outperformance above the Index can be better seen in the following chart

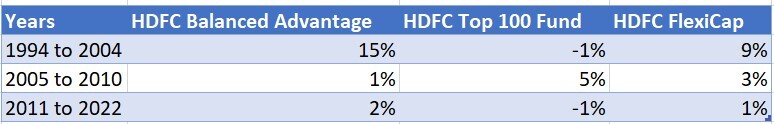

The first 10 years sees some massive outperformance, the next 6 decent outperformance and finally the last 12 not so much. Geometric Average outperformance for the periods

HDFC Balanced Advantage Fund (then known as Zurich India Equity Fund but started out as Centurion Quantum ) was able to ride the bull in the Dot com bubble and then get off before it all crumbled down. As a result, it gave an incredibly good Alpha both in the years of the bubble and the years when the market fell. When markets rose once again from the Ashes in 2004, the fund was once again able to maximize.

But in the last 10 years or so, the outperformance is basically gone. Do note that I use non TRI to compare but am also using a Regular plan (where the bulk of the money I assume is invested anyways). While TRI is seen as the right benchmark, there is no way to get TRI Index returns and hence a better benchmark would be a Index Fund for that is the real alternative investors could have invested into.

When we are looking at long term trends, starting points can create substantial bias. One way to eliminate and smoothen out to see how a fund performed vs its peer / benchmark is to compare returns on a rolling scale.

Short term comparisons to me are meaningless since there is a lot of noise and factor of luck in the short term. Anything from 5 years and above starts providing good understanding.

The first few years were incredible Alpha generators. Way better way to look at the excess returns would be by way of this chart

For investors upto 2014, the funds continued to produce Alpha. Post that, it declined with 5 year excess returns getting into negative territory.

One reason that is given for the decline is his bad picks (or rather contrarian picks). But the contrarian side was what saved the funds during the dot com bubble phase. So, in a way it evens out.

How about the AUM growth? We unfortunately don’t have much data. Anand Gupta was kind enough to share data from 2012. Here is the growth of assets in the scheme over the last decade

But does the above picture reflect the real change? No. Remember, markets have gone up since 2012 and that organic growth would have moved the AUM higher even without any inflows. We need to remove the gains in assets which came in because of the markets to get a better understanding of the numbers. Removing the gains the fund made, here is the rebased chart

While HDFC Balanced Advantage shows strong growth, one aspect that is missing here is the impact of merger of other schemes into it. The other two have actually lost AUM though point to point AUM is higher thanks to the market’s growth.

80% of the Assets under Management come through Mutual Fund Distributors and the data seems to suggest that they were either moving away from the funds or dissuading inventors from adding more. Either way, its finally returns that are the key to continued investments by clients with even the famed Seth Klarman facing withdrawals after years of underperformance

Managing other people’s money is tough but what attracts the best of the minds is the financial incentives that accompany this endeavor. Higher the asset one manages, more the Income and in a way this creates an incentive to focus more on asset gathering than generating alpha for clients.

It’s doubly tough to be a contrarian fund manager if one is an employee because the risk to one’s career is multifold. Most funds with a couple of decades of history generally have seen multiple fund managers getting the hot seat and then being removed based purely on performance.

The risk of being contrary is that when things don’t work out the way one anticipates, everyone would pitch into say how stupid one had to be to invest and lose money in a stock that even a man wouldn’t touch.

In his most recent memo, Howard Marks talks about taking the path not taken. But the example he uses is of the one guy who took a non beaten path and emerged victorious. Those who take a path that is contrarian by nature and don’t succeed are those we never hear about. Remember, Abraham Wald and the Missing Bullet Holes

India hasn’t had a fund manager managing public equities for the length of time Prashant Jain has been at the helm. Nilesh Shah, CEO, Kotak Mahindra Mutual Fund compared him to Don Bradman of our times.

If you look at his outperformance generated by the funds he was part of in the first ten years, he did have an average that no fund manager of today can match. But if you were to look at his recent ten year outperformance, it would be hard not to see him as Kohli, an incredibly talented batsmen but who currently has been out of form for a long time.

Outperforming the markets today is way tougher than it was two decades back as information arbitrages have dwindled down. Everyone has the same information as the next guy. Stray too far from the herd like what a few managers have tried and you shall be pilloried. This even if you actually end up being right. Only time this works is if you are right and the rest of the world is wrong in which case there will be some grudging acknowledgement. But even there, there are big ‘if’s”. And if they fail while trying to be different and generating excess returns? Remember Santhosh Kamath?

Overall, I would say Prashant will pass off as one of the great fund managers in India. While we can quibble on his value add over the last few years, the fact also remains that at no point of time was his portfolio seen as untouchable by other fund managers. Getting timing right with major trends is enormously tough and there is no shame in getting it wrong as long as his clients get a decent return.

Finally I am reminded of the famous dialogue in the movie Ratatouille

Some reading sources:

Recent Comments