The one minute Challenge

A systematic trader faces several dilemmas when he is trying to figure out the best time frame he should use. Should he go with a 5 / 15 minute bar where he will get a lot of signals or should he chose the 60 / 120 minute bar where signals are far less.

For those trading the hourly / 120 minute bar, a secondary question arises. Should his bar start at 9:00 in the morning (even though trading starts at 9:15) and hence have his first hourly bar reflecting 45 minutes and the last hourly bar reflecting last 30 minutes of trade or should he start his bar construction at 9:15 in which case, he will have to deal with the problem of having his last hourly bar of just 15 minute duration (3:15 to 3:30).

A optimal solution recommended for the Indian market scenario is to have 75 minutes and start bar construction at 3:30. This way, all bars are uniform in nature. But 75 minutes is not exactly something you come across in any technical literature. Its just a number that is at the current moment the best way to divide the Indian Market timings into equal number of bars.

While you may wonder as to why such small difference as important, a simple back-test shows how varied the results are for the various time frames and the difference based on the starting bar.

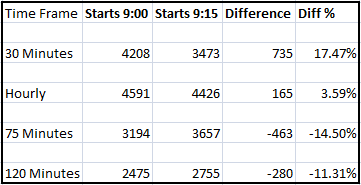

Lets take a simple 3 EMA by 5 EMA system (trade price being the close price) and see how much of a impact the starting time will make to the overall returns. Test period is from 0.1.01.2010 to 31.12.2014 – Nifty Rolling Futures

As you can see, its more or less evenly split. For the 30 minute bar and the hourly bar, backtesting seems to indicate that using 9:00 as the starting time frame would be best suited. On the other hand, if you were using the 75 minute or the 120 minute bar, using 9:15 would be the way to go.

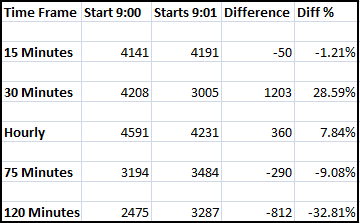

Now, let me complicate things a bit. Should your bar start at 00:00 or 00:01. For example, should the bar reflecting the data between 10:00 – 11:00 start at 10:00:00 & hence end at 10:59:59 or should it start at 10:01:00 and end at 11:00:59 ??

You think I am kidding, well lets take a look at results, shall we

If you are a trader using 30 minute bar or the 120 minute bar, the difference is staggering to say the least. Its no kidding matter to see your results poorer by 32% just because you chose to move the time by 1 fricking minute.

Intraday trading (even of the positional variety outlined above) is tough and its no small matter as to how small changes in where the bar starts, where the bar ends and how long a bar should represent can dramatically vary the end results. Reminds me of the Butterfly effect.

So, what is the solution? Unfortunately, there is no easy way out. You may think that using End of the Day bar can eliminate such things, Right? Well, most systems that are tested on End of Day time frame use the adjusted close and good luck on being able to get in and out at the adjusted close prices. As to those who use Open of next day, you will need a co-located Algorithm system to even be able to come close to buying / selling at those prices.

The idea of this post was not to showcase what is right and what is wrong, but to provide you with data to show how small things can make major differences and hence the next time you think about extrapolating something, do keep this in mind.

Recent Comments