Sell in May and go away – I say no way

A popular adage in the US markets is “Sell in May and go away”. Over at All Star Charts, JC Parets wrote one showing the huge discreprancy in returns between buying in November and selling in April vs buying in May and selling in October. I decided to check whether Indian markets showed any such trends.

I tested the same on the Sensex for the period from 1st Jan 1981 to 23rd April 2014. The results though show that there is not much of an advantage for a investor to miss the months through May to October.

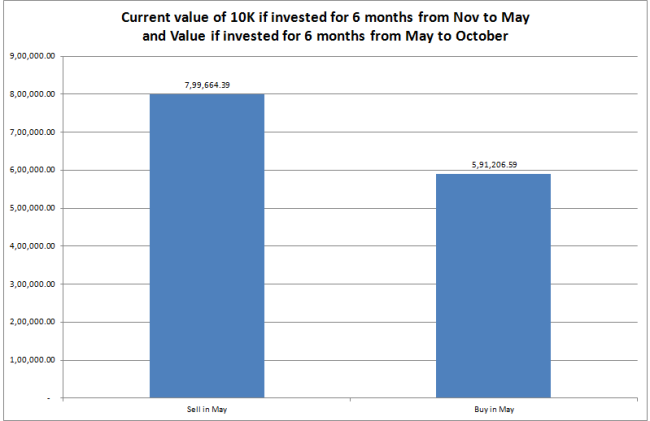

An investment of 10,000 in the Sensex is assumed on the first day of Jan 81 for Sell in May strategy. and 1st May of 81 for Buy in May strategy. Results are as here under

The difference is not too much between those periods signifying that selling in may and going away makes no sense since you shall leave a large part of the market appreciation on the table (or at least, that is what the back-test conveys)

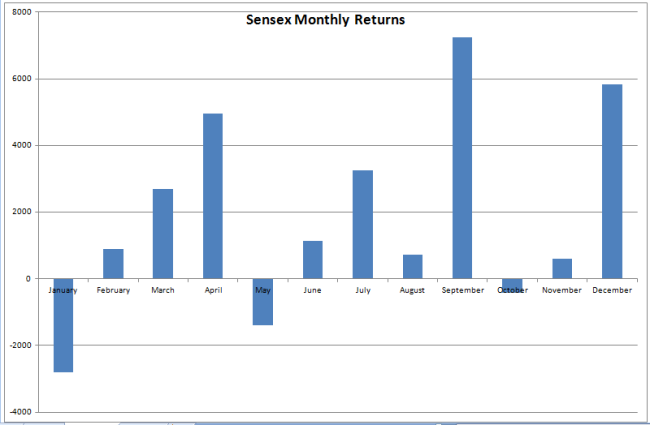

The reason for this can be seen in the Monthly gains chart of Sensex. As can be seen below, good and bad months are spread all along. A Sell in May strategy misses the best month of September while the reverse strategy would miss out on the gains one sees in December and April.

May on a whole has been negative and it would be interesting how it behaves in the current month especially with results of the election being declared. A dip seems to suggest a buy with a exit target in September

Recent Comments