Gann Day & its Implication

Today it seems is celebrated as Gann Day. I learnt this via blogger, Eddy Elfenbein who himself references this article from Barron’s (Link).

Gann has quite a large number of followers who believe that the future can be foretold using methods preached / written down by Gann. While I am a strong disbeliever in one’s ability to know how the markets will unfold in the near term future (its much easier to predict the extreme long term – it will be Up :)).

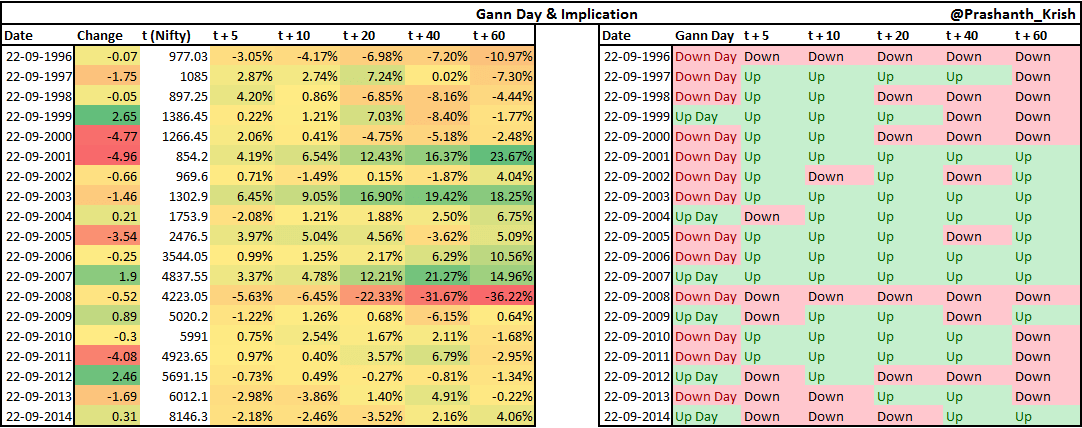

The thing about Gann day as the article explains is that and I quote “when markets are more likely to reverse than any other day of the year.”. Since I believe only when such wide (wild?) predictions are backed by substantial data, I decided to check the behavior of Nifty 50 in the following days of September 22.

Data itself is pretty hazy showcasing more of randominity than there being any order which in itself does not surprise me. A single day cannot be a major turning point year after year. In fact, even in cycle theory, practioniers look out for cycles that vary and aren’t concerned with it being of a fixed nature. Its only the ease of plotting cycles in our charting softwares that make us look for fixed width cycles.

As the data below showcases, after 2008, markets have barely moved much for the next 3 months (60 Calendar days). Then again, there is always a first time 🙂

This article has nothing to do with GANN study. GANN study has nothing to do with %change over T+x days. Its about Market Behavior and Major moves and Turns on specific calculated GANN Dates.

Foremost there is no Fixed dates of GANN for each subsequent year unless the dates are of Permanent Yearly Cycle but those are reference for behavior of markets around that specific date. Permanent Cycle dates were 21-24th sept for topping and we saw the result.

W.D.Gann was a 33rd degree Freemason. You know what does that mean. These people are hand counted till date and pears are Benjamin Franklin, Colin Powell, Winston Churchill, Albert Einstein. Its not for a normal Human being to understand their study in one lifetime.

GANN study tells about price and date predictions much ahead of times and price behavior around a specific date but these dates are dynamic based on previous price actions.

I believe and can prove that any study currently in force is based on GANN study including Fibonacci and EW. Everyone has taken some part of GANN and became famous cause it was no Layman’s Job to have a full interpretation.

Please don’t make your views on GANN based on above article. Its in poor taste and the author does not know the spelling of GANN, I suppose, leave aside what the study is all about.

I am no Authority on GANN but a novice and learner so please don’t have a feel otherwise.

But if its for the matter of a Study, I know even 1% and follow, I must stand to fight for it.

In markets, I am a strong believer in using data to separate the Wheat from the Chaff.

Even the broken clock is right twice a day and this holds good for a lot of strategies / methods that are put out as the holy grail.

Its only a deeper testing can we be really sure as to whether the strategy holds any value or is another Random act of nature.

Firstly you need to know what is GANN Study.

After that find the Dates which are GANN Dates and than calculate how many time Markets have made Tops and Bottoms on those dates and than Publish.

I will Heartily wait for that Article,

Wouldn’t a simpler way be for you to write a article showcasing the strength of Gann & why me (and the Barron’s article) are wrong despite the data? 🙂

LOL 🙂

I will surely think of writing, the day I am able to claim even 10% knowledge of GANN

I have worked under some one who is a expert at Gann & have also done a course. I agree that there is a lot to Learn, but since you are sure that I am wrong, I wondered if you could correct me. Thanks