Are markets still worth buying into?

The current surge in prices has placed me in a quandry as to whether its still a good time to invest in the markets. While Infrastructure Index is up by 20.6% this month alone, we still are way way below compared to the glorious heights that was reached in 2007. Same is the case with a lot of other sectors as well, Realty, Metals PSU Banking Sector being the top dogs that have performed brilliantly in the current month while still being far away from their all time highs.

I believe that we may be entering a new stage in terms of how markets move from here. On one hand, there is huge amount of hope in the market with regard to the prowess of Modi. This has been the key reason for us to see such a rally even before Modi has assumed power as the Prime Minister of India. On the other hand, Modi is not P.C.Sorcar and over exuberance is sure to meet a gory end – not because he cannot deliver what he promises, but because the market just has run way ahead of valuations and all the low hanging fruit may have already been eaten away.

FII’s have been one of the key drivers in the market and in fact have been on a buying spree for quite some time. It was hence a surprise to see them turn bearish (though the amount is piddly) today. On one hand, this may be one of the off days, but on the other, this may also be the start of a profit booking season which if history is any guide does not bode well for markets.

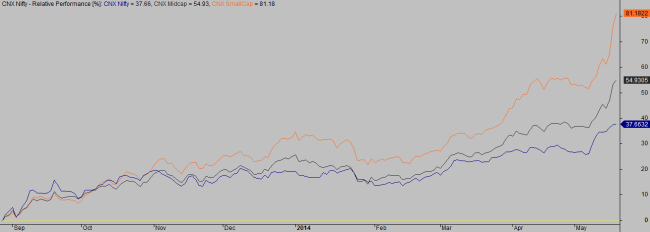

In one of my previous write-ups on Nifty, I showcased as to how Nifty was nowhere near the top as in previous occasions, Nifty has topped out when the small cap index starting to beat the broader index black and blue. On that thought, do take a look at the chart below

The small cap Index has really taken off in the recent times and I wonder whether we may have (or may) see a peak for the short to medium term. On the long term though, the trend is yet to exhaust as can been seen in the chart below (longer time frame)

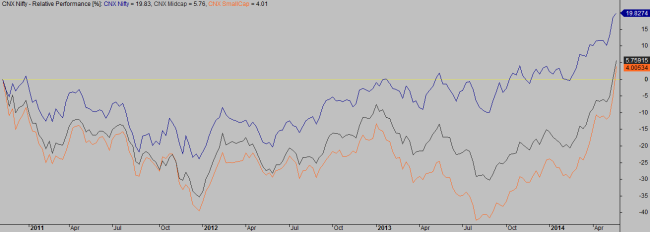

The above chart was discussed by me in early march in this post http://prash454.wordpress.com/2014/03/12/nifty-are-we-in-a-bubble-nearing-a-peak/ and the difference in returns since the time of writing that post is stark. Its interesting to note that despite the sharp rally we haven seen in the last few days, Mid and Small cap Indices are still bit off from the Nifty in terms of returns and only when they start exceeding the returns generated by Nifty should one start taking measures to lower the exposure to markets.

That said, the markets never behave / move in the direction vastly anticipated and what worries me most is the bullish stance taken by almost all broking houses. Below is a list of such targets I was forwarded on WhatsApp

* CIMB Raises Nifty target to 8,150

* BofA-ML raises Sensex target to 27,000

* BNP Paribas raises Sensex target to 28,000

* Citi raises Sensex Dec target to 26,300

* Macquarie raises Nifty target to 8,400

* Deutsche Bank raises Sensex target to 28,000

* CLSA raises India weightage by 2%

* Nomura raises Sensex target to 27,200

* UBS raises Nifty Dec target to 8,000

* ICICI Securities sets Nifty target of 8,100

* Religare raises Sensex target to 27,000

* Goldman Sachs Raises Nifty target to 8,300

For the life of me, I cannot remember when was the last time when we saw every broking house being so bullish about the future. And if every one is a buyer, we either should see a unprecedented boom (somewhat like what we saw in the 2nd half of 2007) or maybe we can take a break here before the next phase of the rally starts.

Either way, I believe that for now the future does look good. As long as one picks companies that won’t go bust anytime soon and avoids leverage (unless you have a full fledged trading system in place), the coming decade maybe the time to generate wealth on the scale one saw happen when markets relocated from 2003 to 2007.

Adios for now 🙂

Recent Comments