3 Years of Momentum Investing

When 2020 started, I had this strong belief that both career wise and portfolio wise, this decade will be the standout in my life. For the first time after being in markets for more than 2 decades as an investor and trader, I was finally comfortable investing based on a strategy that not just appealed to me, was accepted academically and also delivered the goods.

At the end of 2019, the CAGR for my portfolio since inception was nearly 17% and we had already seen 2 years where the majority of the stocks entered bear markets while my portfolio stood back up after every knock, what could really go wrong I wondered. Wuhan challenged that belief like nothing else has.

The key to winning in the arena of investment management comes down to two things – returns and allocation. You may have an asset that generated a great return, but if the allocation was poor, it may not be life changing even though you would get fulfillment in having correctly identified it early. On the other hand, if you had a large allocation and the investment turned out bad, it can set you back by years.

The way out is to diversify, say experts. But diversification as practiced by the majority of investors doesn’t really add value other than enabling them to somehow feel better. What difference would it make to be invested in 3 large cap funds versus one large cap index fund. The final results may turn out to be the same, yet there is a greater comfort with the advisor who asks you to buy 2 funds of each category (Large, Mid, Small, International, Sector) than with an advisor who will recommend that your entire equity allocation should go into not more than 2 funds.

One of the toughest problems that most investors face is staying true to the factor or philosophy they started out with. As humans, we love confirmation of our beliefs to the extent that confirmation bias is a cognitive dissonance. From Value Investing to Quality to Momentum, every strategy has its good times and bad. In the last couple of years, the only one to hold fort has been Quality. This has been especially troublesome for many especially for those on the Value front for while great value stocks seem to be getting killed, stocks with low or even negative growth are standing strong at valuations that most stocks can only dream about.

Passive is now becoming the new active what with every fund house trying to get a foot inside the door of what they think would not click but one they would not want to miss if at all the segment takes off. So, today you have Passive funds for the Large Caps, the Semi Large Caps, the Mid Caps, the Small Caps, International Funds and even a passive bond fund. It’s another matter though that without guidance and one that doesn’t come for free other than from Twitter, Investors are falling prey to recency bias and one that generally doesn’t end well.

Unlike Value or even Quality, Systematic Momentum has very few ardent believers. Buying stocks when it’s making new highs and selling some of them as they come crashing down isn’t something that investors love doing. It’s very unsettling and not comfortable for most.

I recently did a short term course by NYU Professor Scott Galloway and one attribute he says that is common across all successful companies is “Storytelling”. In the world of Systematic Investing, this is completely missing. It’s as if there is no story to be told and the only stories we hear are about Algo firms that went bust – so much for the positivity one hopes to hear.

Coming to allocation part, this is my only portfolio and comprises my total exposure to markets other than for the ELSS funds which anyways are locked in removing any ability on my side to mess things up.

One of my observations during the time when I was a stock broker and even today is that most do it yourself investors don’t really measure their portfolio growth. While many do know the stocks that made them big money and a few stocks that lost them big time, on an overall basis, they find it tough if not impossible to know whether they are doing better than the Indices or Mutual funds or not.

The reason to measure in my opinion goes further than just knowing how we are doing. Data leads to Knowledge and Knowledge leads to Wisdom. While earlier it was tough to measure, thanks to technology, that has become easy today and one I believe every investor should cultivate.

But, enough of banter. What has been the performance and what are the learnings.

A key reason for these posts is to be transparent to the reader while hopefully helping me become a better investor myself.

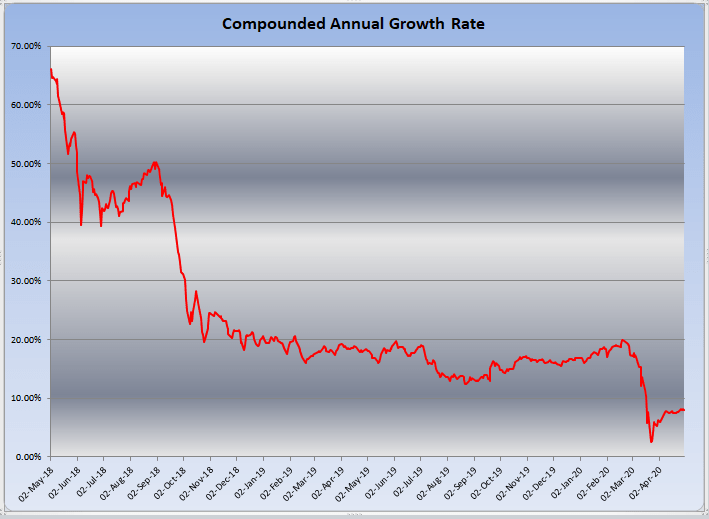

First off, CAGR since Inception

Was quietly plodding around the 18 to 20% mark before it got infected and reduced to a wreck. Stands at 8% currently – not bad in light of what is happening but that is small solace when I look at the drawdown chart.

But performance needs to be monitored against a benchmark. The strategy has despite the setback performed well in line and as per my own expectation. Among non sector mutual funds, the only fund to have performed better is Axis Bluechip Fund with a CAGR of 8.35% over the same period. On a side note, 4 out of the best 7 active funds belong to Axis. The fund house has been on an excellent run in recent times.

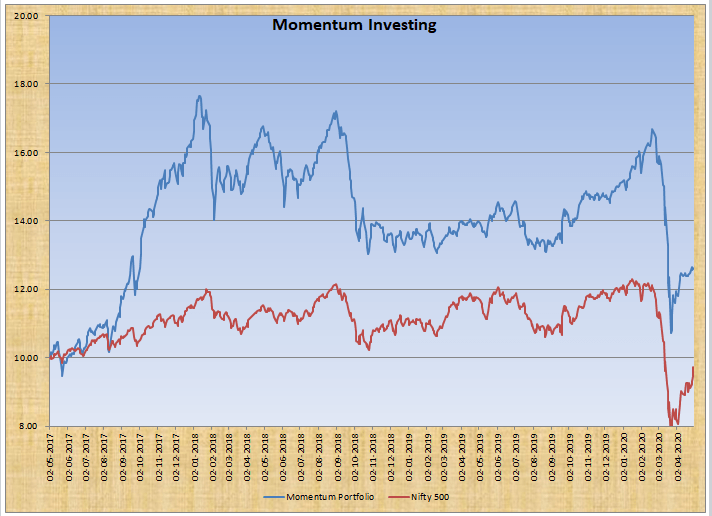

The static benchmark I have used is Nifty 500 since the majority of the stocks that I have bought over time has been from this benchmark even though I don’t filter stocks to be from the Nifty 500 Index only.

The out-performance that started in late 2017 has sustained through and through. Unfortunately over time I have continuously added money (Sipping though not every month) and this means that while the strategy itself is positive, on an absolute basis I am currently slightly negative.

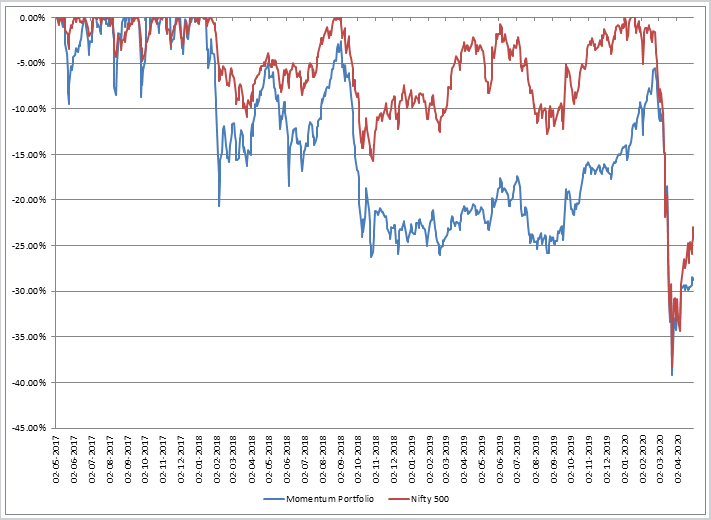

What can I say, No Pain, No Gain or No Mercy, No Malice as Scott Galloway sees it. The only silver lining to my bruised ego is the fact that unlike in 2018 and 2019, my drawdown is now in line with overall markets. That should count for something. 🙂

The Escape from Covid

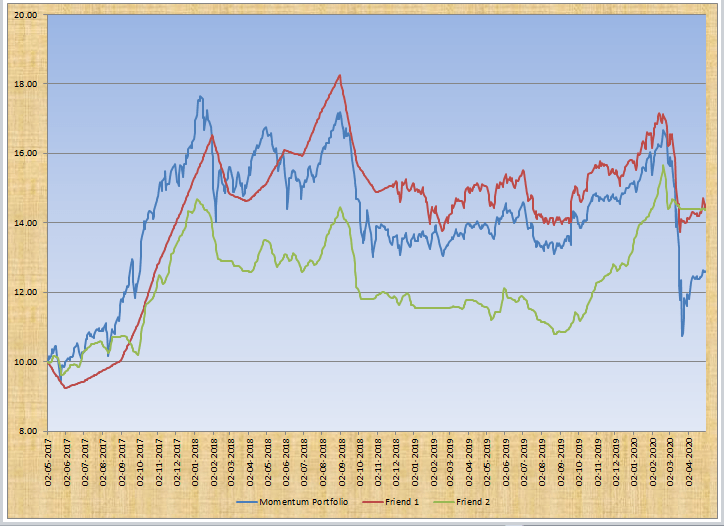

Friends of mine who practise slightly different versions of Momentum but have two things that are different than mine are

- Going into cash during market weakness.

- Weekly Rotation vs Monthly Rotation

Thanks to the availability of their daily NAV, I wanted to compare my strategy with theirs to see if that made sense. Chart comparing on such strategy with mine

The differential as I can see was not much just before Covid happened showcasing the similar end points despite the different paths taken.Post Covid, I am down approximately 14% versus their strategy.

During the last few weeks, I have spent a long time thinking on whether I should have had a market filter to reduce drawdowns but the evidence has been that other than in market falls of 2008 and 2020, such moves to cash have not added value. I continue to tinker with allocation methodology to see if I could get better returns by not selling any stock but having a tactical allocation strategy. A work in progress I would say for now.

The drawdown is a trade-off that I had anticipated based on the backest though when reality hits, it hurts a lot more than just a few numbers on the spreadsheet which is what backtest finally comes down to. Despite the setback, I am still not convinced about the idea of going into cash on every market dip – the costs alone can set you back big time not to mention the feeling of constant churn that has an impact on one’s behaviors.

A superior way would have been to take Insurance to limit the loss as Bill Ackman did with his fund. Then again, that’s why he manages Billions. Who am I kidding. On the other hand, one could start the year by buying Insurance for such an eventuality and roll it up or down every year. I got caught flat footed this time around and I do hope I am better prepared the next time around. This has been a key learning for me and one that hopefully shall add value over time.

They say, Learning never Ends and so is the case when it comes to the world of finance. From the Franklin debacle to the Covid meltdown, there are always things to learn even if some of them come at a personal cost. Then again. who said Learning was Free 🙂

Previous Posts;

Just wondering, would you still suggest to go with this strategy?

Yes Mohit. March was brutal but still inline with expectations and broader market returns.

Brilliant articles! I read all 3 in one sitting. You have a great story to tell. I’m just starting to learn about momentum and can’t wait to learn more. Please do suggest materials that deep dive into the strategy.

Great article. Sorry, I am a newbie here and just starting to play with momentum strategies. Clearly, it works well in the bull market and when it crashes without any warning signs, then we have problem. My question is can we not put a stop loss (like a GTT in Zerodha) for 10-20% of the price? Would this be able to prevent the total loss of money ?

Most of the losses happen not due to one day falls but gradual falls over time. Shorter Rebalance time can help cut off the risks earlier though comes with the trade-off of more trades over longer rebalance periods

Hi, what do you mean by insurance at the end of the article.

Buying put options to offset the losses sustained when markets fell.