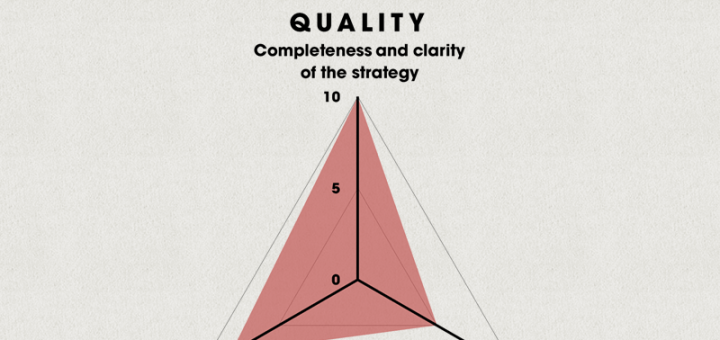

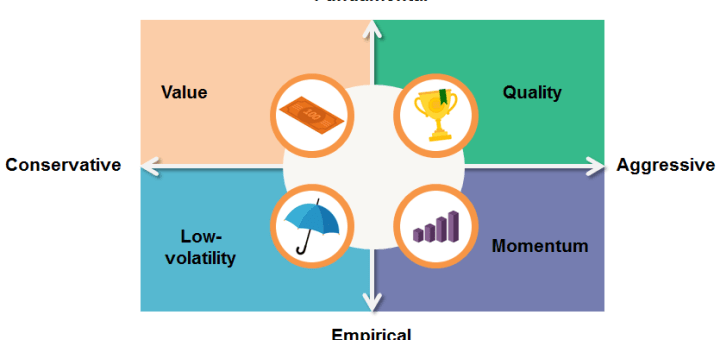

Value vs Quality vs Momentum

I got introduced to Technical Analysis by way of an accident during the time of the Dot Com bubble and I fell in love with it. I loved it for both the simplicity and the fact that the answers were binary in nature with very little between. Pure Technical Analysis though is as discretionary as with any other strategy. Buy...

Recent Comments